Exploring the Challenges of Social Impact Bonds (SIBs)

By Mark Hlady, Finance for Good

Mark Hlady, Chief Executive Officer, Finance for Good, will be attending SEWF 2013.

People that enjoyed this article may wish to check out the SEWF 2013 program streams "Social Finance."

SEWF 2013 is reposting this article as part of an ongoing series of articles by or about SEWF 2013 attendees.

SEWF 2013 has an amazing array of speakers, but we didn’t want the event to be a passive experience of one-way communication. We know our attendees also have powerful insights to share – insights that can inform and inspire others and enhance the evolution of social enterprise and social innovation.

If you are a SEWF 2013 attendee and have created or want to create articles on key ideas, insights or issues relating to social enterprise or social innovation, we would be happy to post them. Please keep in mind that these articles cannot simply be profile pieces – that is what Sched is for.

Send your article to .

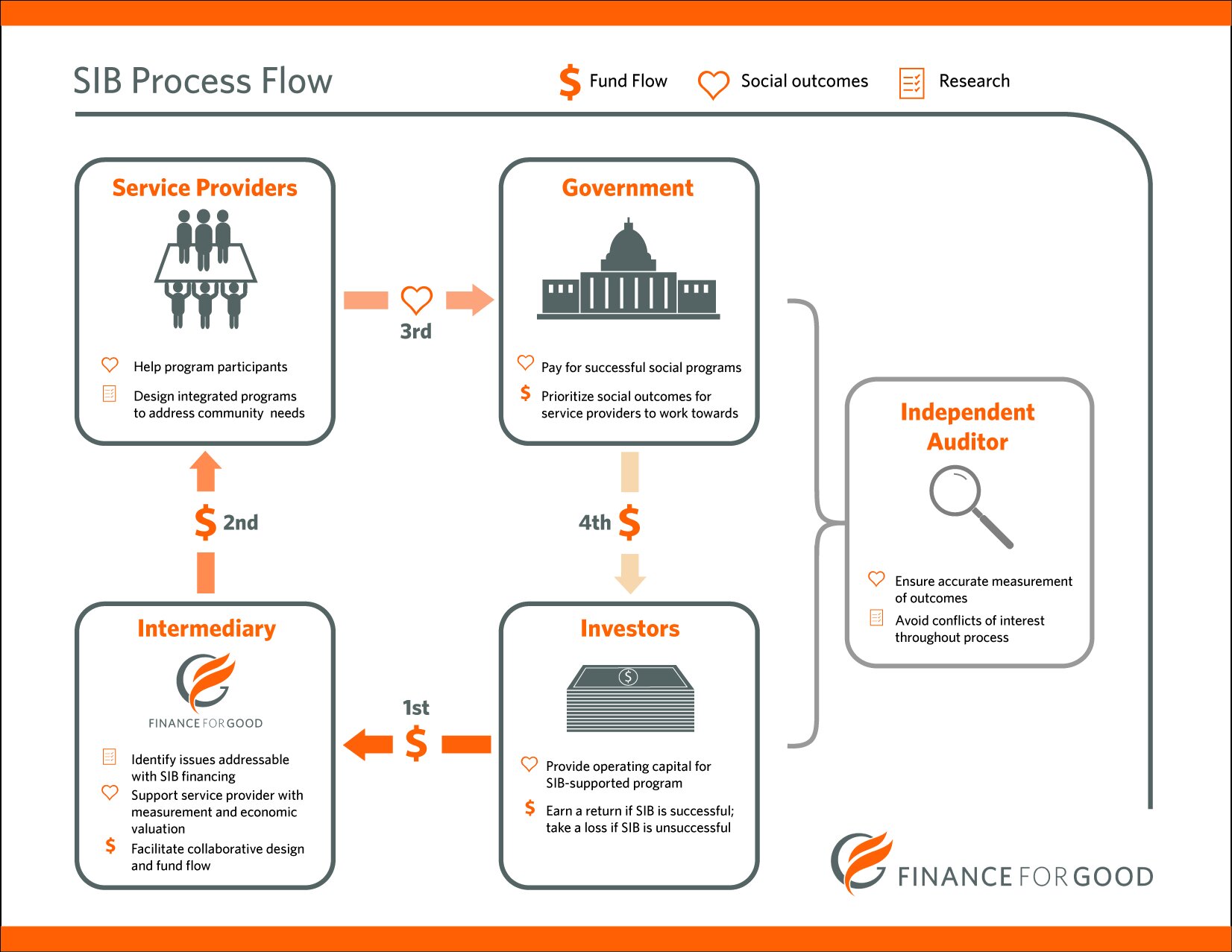

At Finance for Good (FFG) we are looking forward to the Social Enterprise World Forum. The gathering will provide a great opportunity to develop our collective understanding of outcomes financing, and how it can be used to support social enterprises. A previous article on this website highlighted a few of the issues that will likely be top of mind for participants interested in social finance (and social impact bonds).

First, the article brought up the notion of where SIBs are and are not applicable. This is a question we are often asked by social sector organizations interested in accessing SIB funding and by governments interested in determining what local issues they can address with SIB financing. It is understood at a macro level that SIBs can be used to fund programs that decrease recidivism or improve educational attainment, but at a local level, a commissioner must also explore the availability of good data and the capability of local service providers.

First, the article brought up the notion of where SIBs are and are not applicable. This is a question we are often asked by social sector organizations interested in accessing SIB funding and by governments interested in determining what local issues they can address with SIB financing. It is understood at a macro level that SIBs can be used to fund programs that decrease recidivism or improve educational attainment, but at a local level, a commissioner must also explore the availability of good data and the capability of local service providers.

Given the magnitude and criticality of this question Finance for Good developed a SIB feasibility assessment framework that can be accessed free of charge.

It is important to remember SIBs are not a panacea, and rather one tool we can use to create social change.

Second, it is important to understand what’s in a name when it comes to social finance. This conversation has come to the forefront due to two factors – first the newness of social finance as a sector, and second the misleading nature of the name “social impact bonds.”

SIBs are not actually bonds. SIBs are pay–for-success contracts, which generally offer returns more similar to an equity instrument, rather than a bond; their returns are variable like equity, rather than fixed as with a bond.

To avoid this confusion of a SIB not being a bond, practitioners in the US renamed the tool when they brought it over from the UK. In Canada the term SIB is still most widely used, but members of the federal government have coined the term “community benefit investments” to be used in the place of “social impact bonds,” though this new term has yet to gain popularity.

Third, it is worthwhile to understand how SIBs provide benefit beyond simply adding new money to the social sector. Fundamentally SIBs create a mechanism to share operational risk associated with a social program or social enterprise. Removing operational risk from government allows a department to launch a program that they think will be successful, but don’t know will be successful. This means government can make a decision without having perfect data (which is often the case in the social sector). Removing risk from the service provider agency is also important. In the current system many providers need to stick to doing what they have always done because that is what funding is allocated for. With a SIB, an organization is charged to achieve an outcome and modify services as required to help the clients in the program.

All of this means an increased emphasis on developing creative solutions to truly address the root causes of issues.

A lot of work is still required to take SIBs, and other social finance mechanisms, from concept to reality, and we pleased to be part of team doing what is needed. We are helping government and community groups determine where SIBs are applicable, working to define a consistent nomenclature for tools, and supporting social organizations to better help their clients. We are looking forward to attending all the sessions in the social finance stream at SEWF and seeing many of you there.

Tags: SEWF Attendee Articles, Social Finance, Social Impact Bonds

SIBs seem to need much clarification in many respects, and it leads to high setup costs: http://www.socialenterprisebuzz.com/2013/08/27/the-first-retail-social-impact-bond-cancelled/

Hi Spencer,

Hi Spencer,

The article you mention is a little misleading as it refers to a product that invested in a SIB, but was not a SIB. The SIB it was going to invest in raised sufficient funds and is now operating, but this particular means of investing in it failed to attract enough investors.

For a little more clarification see data.gov.uk/sib_knowledge_box/